Contents:

- What is Forex Technical Analysis

- New To Forex Trading? Here’s Everything You Need To Know

- Did you remember what I had written on last Monday about EURUSD in my last Global currency update

- Average True Range (ATR)

- what happens if move backwards after the resistance and levels are for our paid members only by SMS with exact time & level.

- Forex & Crypto Fundamental Analysis

That’s an area that was previously resistive, so would make sense that we should find support in that area. Because of this, we have to prefer shorting the market based upon short-term rallies that show signs of exhaustion, simply because it gives us a little bit more room to move at this point in time. Regardless though, we have noticed whatsoever in buying this market at the moment. Silver markets initially rallied during the course of the week, but turned right back around just below the $18 level.

FOMC raised interest rates for the first time in almost a decade shifting from its lose monetary policy stance to a gradual and calculated tightening of the support as it sees the US economy recover going ahead. The initial reaction from commodities market was a muted one with only a small knee jerk reaction in the market. The new year begins with the interest rate differential strongly favoring the U.S. The Fed just raised rates on December 16 shortly after the European Central Bank announced additional stimulus on December 3. The interest rate spread is expected to widen during 2016 because the Fed is scheduled to raise rates several times with the next coming in June 2016 while the ECB may have to continue to tweak its stimulus program. Based on the close at 98.745, the direction of the market this week is likely to be determined by trader reaction to the short-term pivot at 98.96.

Social trading: what is it and how does it work? – FOREX.com

Social trading: what is it and how does it work?.

Posted: Fri, 28 Apr 2023 09:35:17 GMT [source]

Trendlines are straight lines drawn on a chart by connecting a series of descending peaks or ascending troughs . Technical analysis is based on the theory that markets are chaotic and no one knows exactly what will happen next, but at the same time, price movements are not completely random. The mathematical theory of chaos proves that in a state of chaos there are certain patterns that tend to repeat themselves. MNCs, SMEs and start-ups globally have received accurate data and forecasts regarding specific sectors of the Forex & Crypto market. Our research team are highly qualified with diversify portfolios having experience in the industry with more than 11+ years.

What is Forex Technical Analysis

Therefore, the Government must prepare an implementable action plan to incentivize farmers to cultivate more pulses by providing seeds and technical support, the chamber added. Chana recovered moderately after the recent massive fall, while Guar failed to recover on low demand. Moody’s Investors Service says that it has changed its outlook for India’s banking system to stable from negative because of the gradual improvement in the operating environment for Indian banks. India will record GDP growth of around 7.5% in 2015 and 2016, according to the latest report by Moody’s . Growth has been supported by low inflation and the gradual implementation of structural reforms. Moody’s points out that an accommodative monetary policy should support the growth environment.

- Net positions of the money managers has collapsed due to the build in short positions and most recently an entity has dumped zinc onto the very visible and monitored London Metal Exchange.

- Every time we pullback it should be a buying opportunity and we think that the market will probably try to reach the 1.25 level next.

- At this point in time, it’s not until we get above the 0.70 level that we are comfortable hanging onto a longer-term trade though.

- Decide on your Forex strategy – Deciding on your Forex strategy is the first step towards making profitable Forex trades.

- Helping to underpin the market is the continual drop in the number of oil rigs.

If the polls shift back the other way, this may give investors an excuse to book profits, but not necessarily put in a top because of the lingering uncertainty. Prices were also supported and driven higher by worries over Britain’s June 23 referendum which will decide whether the UK remains a member of the European Union or leaves. Safe haven buying helped drive August Comex Gold to a three-week high on Friday, putting it on track for a second straight weekly rise.

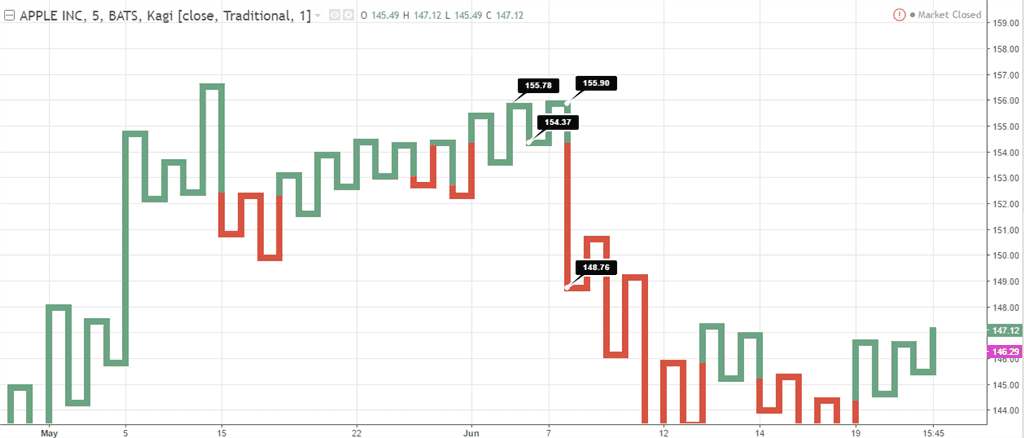

New To Forex Trading? Here’s Everything You Need To Know

The EUR/USD pair initially tried to rally during the course of the session on Tuesday, but fell significantly and broke down below the 1.12 level. This signifies that the EUR/USD pair will more than likely try to reach down to the 1.10 level after that. The rallies that appear from time to time in this market should continue to be selling opportunities on signs of exhaustion. At this point in time, the market seems to be very negative, so therefore continuation or rather a break down below the bottom of the candle for the session on Tuesday should be a nice selling opportunity. The EUR/GBP pair fell significantly during the course of the week, and it appears that we are going to continue to fall from here, perhaps reaching down to the 0.75 level.

The USD/JPY pair fell significantly during the course of the week, breaking down below the 105 level. That being the case, the market looks like this significant breakdown could lead to much lower levels. The market will more than likely try to reach down towards the 100 level now, so at this point in time it’s likely that the sellers will continue to push this market going forward. However, I believe that it will be easier to trade off of shorter-term charts at this point in time as the Bank of Japan is most certainly paying attention.

As we close below the $1150 https://1investing.in/, it appears of the market is going to continue to drift lower overall. We have no interest in buying this market right now from a longer-term perspective yet, but do recognize that the $1100 level could end up being massively supportive. Longer-term trading gold is going to be very difficult although we do think that it goes higher over the longer term in terms of years, at this point in time there’s no rush to get involved. The silver markets initially rallied during the course of the week, touching just below the $16.50 level. At this point in time, the market look like it had broken out to the upside, but turned back around drastically in order to form a massive shooting star. It now appears the 15.50 level will be supportive, and if we can get below there the market will probably drop down to 14.50 or so.

Keep in mind that the strengthening US dollar will continue to work against the value of Brent markets and several commodity markets in general. I have no interest in buying this market until we break above the $52 level, as it would show a significant breakout above resistance. At that point in time, the market will probably try to reach towards the $60 level. However, I do not think that it’s going to be easy to do such a thing, and as a result I believe that supply increasing will continue to weigh upon the value of this commodity as well. Ultimately, I believe that selling is going to be the easiest thing to do but we need to see a break down from current levels in order to do so at this point in time. The New Zealand dollar initially tried to rally during the course of the week be as you can see has turned completely around and ended up forming a shooting star which of course is a very negative sign.

Did you remember what I had written on last Monday about EURUSD in my last Global currency update

However, the candle that form for the week was a shooting star, and that of course is a negative sign. With this being the case, it’s likely the gold could pull back a little bit from here and try to build up momentum to continue to go higher. A break above the top of the shooting star would also be a buying opportunity as well, as there is a lot of concern about currencies right now.

Rallies are selling opportunities as well, as the downward pressure simply continues yet again. Given enough time, we have no doubt that the market will continue to go lower. In fact, we don’t even have a scenario in which we are willing to buy Brent at the moment, and with that being the case we don’t even look for long positions.

Because of this, I’m looking for corporate governance opportunities but I am actually looking for them on short-term charts, as I believe there is far too much support just below to try to hang onto a longer-term selling position. The EUR/JPY pair initially tried to rally during the course of the week but found enough resistance above the 115 level in order to find sellers. We ended up turning things back around to form a relatively negative candle, and as a result of the query we continue to grind back and forth. If we do break down below the 114 level though, I feel that the market will reach down towards the 111 level.

Average True Range (ATR)

With this, the market looks as if it will continue to struggle to go to the upside, but eventually we believe that the sellers will take control. However, this is a market that still has a massive amount of resistance and selling pressure, so we have no interest whatsoever in buying. The AUD/USD pair initially tried to rally during the course of the week but turned back around to slam into the 0.70 region. This area is the absolute bottom of the market, but it now looks as if the market could very well break below there. If we make a fresh, new low, the market will then start to reach towards the 0.68 handle.

The crude prices shot up from $25 per barrel to $50 per barrel in last six months on the back of pickup in demand from China, India and reduction in stock piles in US. Saudi Arabi’s crude oil supply to Asia is likely to remain steady in July, Reuters reported today. The world’s top crude exporter’s supply to Asia will remain unchanged from June, as per the report. Seven European companies has struck crude oil purchase deal with Iran, as per reports.

As you get more experienced and come to know about the tricks of the trade you can diversify and start investing more fund and consider different currency pairs for trading. Scalping or scalp trading is also a popular type of forex trading where you scalp or get hold of trades for a mere few minutes. This can happen many times during the day, but you can make small trades each time.

The USD/CAD pair went back and forth during the course of the, showing quite a bit of volatility. We believe that the 1.35 level below is still the support that the market will continue to pay attention to, but eventually we will more than likely break above the 1.40 level. It is at that point in time that we will start buying this market again as it should continue the uptrend towards the 1.45 handle given enough time. We have no interest whatsoever in shorting this market, at least not until we get well below the 1.35 handle.

what happens if move backwards after the resistance and levels are for our paid members only by SMS with exact time & level.

With that being the case, the market looks as if it is struggling above with the formation of a shooting star. With that, the market should then head to the $40 level, and with that we feel that the market will continue to have bearish pressure. However, if we managed to break above the $50 level, we could be buyers and hanging on for longer-term moves. In the meantime, we think it’s best to leave this to the realm of short-term trading. The EUR/JPY pair fell significantly during the course of the week, testing the 135 level. That area offered plenty of support, and we bounced in order to form a bit of a weekly hammer.

In an unexpected announcement Iraq said it is willing to play an active role within OPEC to support oil prices, said on Saturday, without clarifying whether it was prepared to back a possible agreement to freeze output. Trump’s comments could give a push to efforts to revive the Depression-era Glass-Steagall law that separated commercial lending from investment banking. Money managers increased their net long position in COMEX gold contracts for the sixth straight week to April 25, U.S. government data showed. This is the fundamental knowledge that you need to have before you start with the trading.

The market is also trading on the strong side of a major retracement zone at .6863 and .6398. September Crude Oil futures posted a potentially bearish closing price reversal top in June indicating that the selling may be greater than the buying at current price levels. This could lead to a 2 to 3 month correction equal to 50% to 61.8% of the last rally. The direction of the market this month is likely to be determined by trader reaction to last month’s high at $18.90. There was an interesting analysis published over the weekend on trends in oil prices. The article reports that oil prices will not exceed $60 a barrel in the short-term perspective, according to the forecasts of the British economic research and consulting company Capital Economics.

To accommodate different trading styles, the page provides a technical summary geared toward different time frames. Finally, if the pair you trade is not listed, clicking on the customize quotes link offers a more comprehensive list of currency pairs to choose from. This is the most common myth about technical analysis that technical analysis is only appropriate for intraday traders or short-term traders. Technical Analysis existed way before computers were common and many successful investors have openly accepted the use of technical analysis for long term investments. Technical analysis is used by all types of traders and investors on all time frames from a 1-minute chart to a monthly chart. The EUR/USD pair rose during the course of the week, testing the 1.14 level several times.

What’s the difference between technical and fundamental analysis? – https ://www.ig.com

What’s the difference between technical and fundamental analysis?.

Posted: Wed, 19 Apr 2023 20:53:51 GMT [source]

However, the Japanese yen has been selling off recently, and as a result we feel it’s only a matter time before this market breaks out although a pullback may be necessary. We believe that we should see buying opportunities below, especially near the aforementioned 135 handle. Oil prices can be particularly responsive to unrest or violence in the Middle East, one of the world’s biggest oil-producing regions. Oil Prices were up more than 8% last week, as expectations of falling production and growing global demand have boosted the market. If we broke above the $56 level, at that point in time we recognize that the market would essentially be changing trends, and as a result we would be willing to deal with massive amounts of volatility.

Silver Forecast: Continues to Look Upwards – DailyForex.com

Silver Forecast: Continues to Look Upwards.

Posted: Mon, 01 May 2023 08:17:30 GMT [source]

If the trends of rising prices continue, the profit margins could be hit since the corporate India is not in a position to pass on the rising raw material cost to the consumers even among the industrialized goods. This means more volatility especially if the financial and currency markets take another hit like they did on June 25. “We need to continue to work toward market stability,” he said, signaling Tokyo’s readiness to conduct yen-selling intervention in the market if it deems yen rises as excessive. Basically, we should see an extension of the current rally in July if global interest rates continue to plummet along with the threat of more stimulus.