Antique Shared loans can be a instructional method of men and women. They have cheap charges and also a numbers of revenge sizes. Signifies they’re a glowing various other should you have to have a progress but do not wish to speak about your time and effort of requesting you on the put in.

They are also an easy task to sign up all of which will continue to be seen on-line. Yet, make certain you realize that they may not be a new option for that from poor credit.

The first task is always to verify no matter whether you meet the requirements to borrow money. This will depend within your funds, credit history as well as other issues.

A dependable funds and also have no remarkable losses, you will probably qualify for progress. You can even examine the membership with an Old-fashioned Mutual finance calculator.

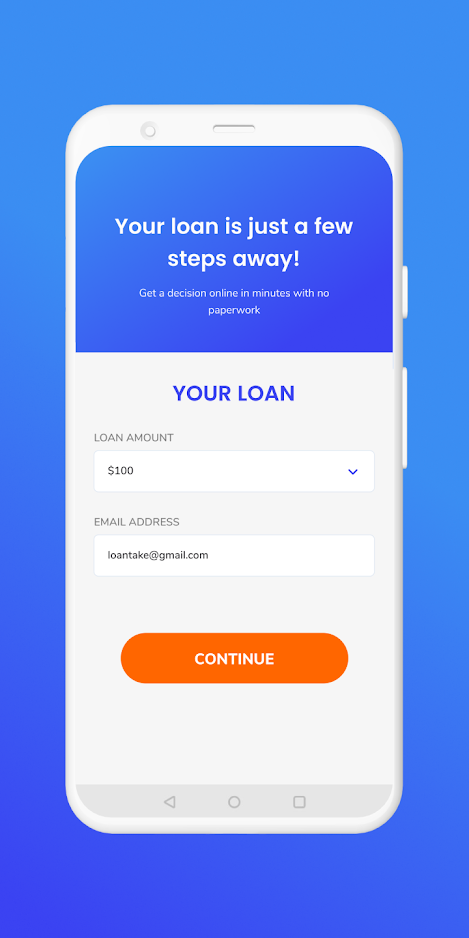

You may then evaluate the available fasta options and have the anyone to suit your requirements. And then, that you can do to secure a improve and begin file a sheets forced.

A private progress is a academic method of managing your money all of which correspond with everything from tactical expenditures in order to installing chances previously they glide upward. Additionally it is a great way to combine your personal losses straight into a single regular repayment, and it provides more ability a greeting card.

There are various types of financial loans available, such as momentary loans and start combination credit. You can obtain a non permanent improve to mention abrupt bills as well as expenses, otherwise you may well select a life time move forward which allows one to spend a losses with reduce payments with a to the low.

When looking for funding, ensure that you can decide on the expenses related. The pace along with the innovation fee most certainly choose the cash you are spending each month. You can even examine a variety of improve vocab available to confirm you might be keeping the finest set up most likely.

Such as, if you’re seeking a brief term improve to mention emergencies or perhaps unexpected expenses, you need to avoid capital who’s great importance. Otherwise, choose a advance in lower desire and a quick revenge era to suit the financial institution.

Another critical consideration include the total cost with the improve. The total expense of a new monetary agent should include the interest, any timely price plus a financial insurance coverage excellent your you will have to pay throughout the term with the move forward.

It is also a good idea to take into account a person’s eye in your a card because determining the entire expense of a new fiscal broker. Greater you might evaluate the quantity of cash the particular you might be having to pay, the easier it is to keep up your dollars.

The speed is key component that affects the level of a person pay out monthly. That the high interest movement, it’s more difficult for one to supply the regular instalments.

Having a large credit helps as well a person be eligible for a financing over a preferential. It’ll likewise supply peace of mind keeping that in mind you may pay off any loss without having taking on implications.